13 Secrets Real Estate Agents Wish You Knew

Thinking of putting your house on the market? These home improvement tips from Canadian realtors can help you get the most for your property.

This is Exactly How Long Your Drapes Should Hang, According to Brian Gluckstein

Canada’s most influential interior designer reveals the secrets behind his effortlessly elegant style.

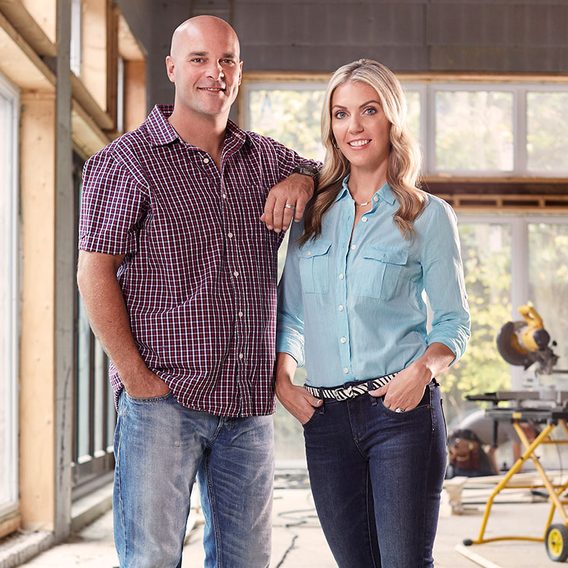

Bryan Baeumler’s Best Kitchen Renovation Advice

Considering a kitchen makeover? Don’t swing a sledgehammer until you’ve consulted HGTV star Bryan Baeumler’s rules for a painless reno.

20 Tricks to Keep Your House Cool Without Air Conditioning

Turning up the AC also means emptying your wallet. Check out these budget-friendly ways to beat the heat this summer.

Sarah Richardson’s Do-It-Yourself Decorating Secrets

Stretch your decorating dollar with these budget-friendly tips from HGTV star Sarah Richardson.

Hilarious DIY Jokes That Will Bring Down the House

Sometimes the only way to make it through a reno is to laugh. These DIY jokes can help you see...

Brilliant IKEA Bookcase Hacks That’ll Inspire You to Think Outside the Box

These storage solutions may look high-end, but they all began with IKEA’s affordable Billy bookcase.

Garage Door Won’t Close All the Way? Here’s How to Fix It

The extent to which your garage door opens and closes is controlled by its travel setting. Here's how to adjust...

7 Ways to Protect Your Garage From Burglars

Here are a few simple ways to deter burglars from getting into your garage.

Quick Home Repairs You Can Do in 10 Minutes—or Less!

Need a quick fix for that broken chair, showerhead or window blind? You can tackle these do-it-yourself projects in no...

Budget-Friendly Ways to Boost Your Home’s Curb Appeal

Treat your home's exterior to a full facelift—without breaking the bank.

10 Things People With Organized Garages Have in Common

We all know a neighbour or friend with a super-organized garage. Turns out people with tidy garages know these storage...

How to Save Your Laptop After a Spill

Spilling coffee, juice or water on a laptop might seem like the end of the world, but there’s a good chance...

Home Hacks That’ll Stretch Your Decorating Dollar

These quick fixes deliver designer results—for a fraction of the cost.

Always Keep These in Your Home For Good Luck

Four leaf clovers aren't the only lucky charms at your disposal.

Never Do This If You’re Planning on Selling Your Home

These seemingly harmless renovations could send your home's resale value into a tailspin.

What I Wish I’d Known Before Hiring a Contractor

On the hunt for a contractor to handle your home renovation or repair job? These helpful hints could save you...

This Simple Step Could Shave 15% Off Your Monthly Heating Bill

Five strategies to beat the deep-freeze—without breaking the bank.

Painting Tips the Pros Don’t Want You to Know

Get professional-looking results at a fraction of the cost of hiring painters.

The Easy Way to Melt Ice You Never Knew About (Hint: It’s Not Salt!)

No rock salt? No problem! Here’s how to avoid slipping and sliding on your driveway this winter.

Is It a Valuable Antique, Or Just Old Junk?

In these days of economic uncertainty, it would be wonderful to believe that so many of the things we hold...

Is a Heated Driveway Worth the Expense?

Our home experts weigh the pros and cons of radiant heating slabs.

25 DIY Christmas Decorations Anyone Can Make

Get ready to deck your halls with these simple holiday crafts—and get the whole family involved in the Christmas festivities.

8 Festive Flowers to Bring Home This Holiday (That Aren’t Poinsettias)

Although poinsettias are the go-to when it comes to festive florals, there are plenty of other options that strike the...

20+ Simple Home Hacks to Save Money

These thrifty tricks could save you as much as $500 a year!

100 Vintage Home Hacks That Are Still Brilliant Today

These tips and tricks for the home have been passed down from generation to generation, but do they still hold...

The One Question You Need to Ask Before Hiring a Plumber

...And more helpful hints when it's time to call the pros for your home repairs.

20+ Ways to Make Your Home Cozy This Winter

From candles to flannels, here’s our guide to nesting when the weather outside is frightful.

10 Great Hammocks You Can Buy Right Now

Spending more time than ever in your own backyard? A comfy hammock is one of the easiest—and most affordable—ways to...

100 Home Improvement Hacks You’ll Wish You Knew Sooner

Sometimes those head-scratching home improvement moments turn into "Aha!" ideas.

Guide to Antimicrobial Home Hardware and Housewares

A wide range of antimicrobial home hardware and housewares may make the high-touch surfaces in your home safer from bacteria...